real estate Investing in Japan – Guideline –

Tidbits on buying a condo

real estate Investing in Japan – Guideline –

Overview, Regions

Hokkaido, Tohoku, Kanto, Chubu, Kansai, Chugoku, Shikoku and Kyushu ( incl. Okinawa)

Advantages of Japanese Real Estate

- Fee simple

- No disadvantage for non-residents

- Registration managed by Legal Affairs Bureau

- Transactions conducted by certified, licensed agents

- Clear and Established fees

- Building code established in 1950

- Government approval required

- Strict quake-resistance standard established in 1920, updated in 1981

- 10th largest population in the world

- JPY is a stable international currency

Types of Ownership

Freehold

The most popular right of real estate usage is freehold ownership (fee simple). A freehold interest is considered to be absolute ownership that lasts forever. Land and buildings are regarded as independent real estate in Japan, so there are respectively 2 types of real estate ownership.

Strata (Sectional)

Strata title is a form of ownership devised for multi-level apartment blocks and horizontal subdivisions with shared areas. A condominium building is a good example. Each person owns their individual unit independently, the land underneath the building is owned in a percentage form by all owners according to the share of their unit.

Leasehold

A lease is a contract between a landlord and a tenant. In return for payment of rent a tenant is granted exclusive use and occupation for their own needs.

Unlike some markets in the region, Japanese real estate ownership regulations do not discriminate between domestic and foreign owners. There are no regulatory barriers for non-residents to own property in Japan.

The most common ownership type in Japan is Freehold. The owner maintains exclusive right to use, possess, develop, dispose of it by deed or will, and generate profit. A fee simple represents absolute ownership of land, and therefore the owner may do whatever he or she chooses with the land. If an owner of a fee simple dies intestate, the land will descend to the heirs.

Investment Process

Select an Agent

Identifying a qualified agent who will represent your interests in a transaction is key. Your agent should have property appraisal capabilities and no conflicts of interest. Bilingual capabilities are recommended for foreign buyers.

Property Research

An experienced, unbiased agent will be able to provide wide exposure to available properties, both publically available and off-market.

NDA, Inspections

Negotiations and inspections may begin once property has been selected. Buyers and/or their representatives should inspect properties to fully understand the condition of the building and its location. Agents can provide the buyer an initial analysis of the property. Detailed documents and information are disclosed to prospective buyers after signing a Non-Disclosure Agreement (NDA) or Confidentiality Agreement (CA).

LOI

A buyer expresses serious intent to purchase the property by submitting an offer letter or a letter of intent (LOI ).Typically the LOI is not a legally-binding document but culturally carries significant importance and is considered very seriously.

Due Diligence, Financing

Sellers typically issue an acceptance letter once basic agreement is reached on the terms in the LOI. Buyers then commission due diligence work including physical inspection of the property (ER report), Appraisal, market reports, cash flow analysis, legal investigation, debt financing and the preparation of investment structure and entities.

Exchange contracts

Purchase and Sales Agreements (PSA) are legal contracts that obligate a buyer to buy and a seller to sell a product or service. PSAs are employed in real estate transactions to protect the interests of both parties before the deal closes. It is possible for PSA and Closing to occur on the same day. Commonly however, there is a 1 month interval.

Generally, the seller requires the buyer to make a down payment of 10% of the sales price.

Closing

The closing is completed once the seller has received the balance of the sales price and the buyer has recorded the official change of ownership in the registry.

We recommend consultation with attorneys, accountants, and other professionals throughout the sales process.

Acquisition Costs

Agents Fees

Brokerage fees are typically negotiable, consumption tax is applicable. Realtors must provide “Property Disclosure Statement “ before the contract date.

Typical Fee:Up to 3%

Legal Fees

A Judicial Scrivener is a paralegal who settles and registers property transactions.

Typical Fee: it depends on setting loan. JPY 150,000 – 500,000 though negotiable

Consumption Tax on building

Buildings are subject to consumption tax. Sales of land are exempted from consumption tax.

Typical Fee:10%

Acquisition Tax

Acquisition tax is levied at a flat rate. The tax is levied on the valuation of the property ( assessed value) as determined by local government agencies, which is usually around 60% to 80% of the market value of the property . A reduced acquisition tax rate may be applicable for residential and personal use until 31 March 2022.

Typical Fee:4% (Land) / 3% (qualified residential & personal)

Registration Tax

Registration tax is levied at a flat rate for the assessed value of land and building. A reduced registration tax rate may be applicable for purchased land until 31 March 2022.

Typical Fee:1.5% (Land) / 2% (Building) / 1.5% for qualified land purchases until March 31, 2022

Stamp Duty

Stamp duty is levied on the deed of contracts concerning the transfer of real estate properties.

Typical Fee:Varies, maximum JPY 540,000 for properties above JPY 5 billion

ACQUISITION costs CAN TOTAL approximately 10% of the sale price

We recommend consultation with attorneys, accountants, and other professionals throughout the sales process.

Operating Taxes

Annual Property Tax

Property taxes include fixed asset tax and city planning tax which are payable by individuals and companies which own real estate as of January 1st of each year. The property tax rate is usually

Tax:1.7% of the tax assessed value of the property.

Consumption Tax

Consumption tax is levied on rents for non-residential leased space.

TAX:10%

Income Tax

Applied to income or capital gains obtained by individuals through the sale of real estate. Taxes for corporate ownership applies to companies which have taxable income. The individual income tax rate in Japan is currently about 50% and the corporate tax rate is currently about 30%.

TAX:50% (Individual) / 30% (Corporate)

You will be allowed to claim deductions for expenses that apply “wholly and exclusively “ to your real estate ( such as borrowing costs, management costs and depreciation cost).

Common Corporate Ownership Structures

The principle forms of business organization are: Stock Company (KK), General Partnership Company , Limited Partnership Company or Limited Liability Company (GK).

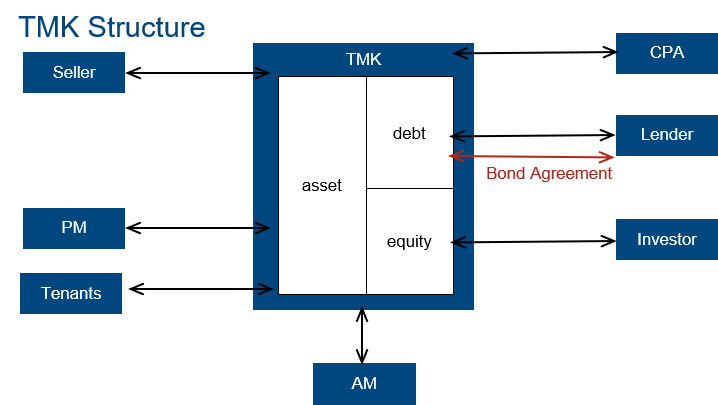

A TMK is a special purpose limited company that can only be established and used in connection with the securitization or monetization of certain prescribed assets, including real estate and trust beneficiary interests in real estate.

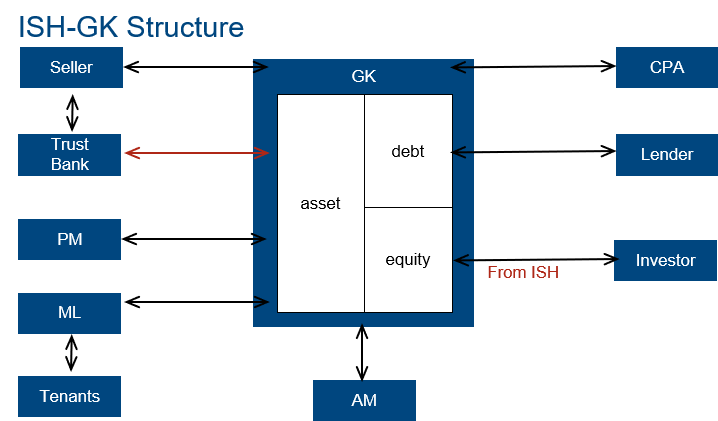

There is a range of options available, from the standard KK or GK vehicles that are widely used to own and operate businesses in Japan by domestic owners, to the more sophisticated and generally more tax effective TMK and ISH-GK structures preferred by foreign investors.

TMK and ISH-GK structures are potentially more tax-efficient but attract a range of regulatory requirements ( Filing an asset liquidation plan, distribute dividends of more than 90% of profits, etc).

Investors who seek a simpler, more straight-forward structure usually opt for the KK/GK structure.

Financing

Individuals

Japanese banks tend to only offer loans to foreigners with permanent residency status. General prerequisites for housing loan include: 1. Reside in Japan, 2. Ability to provide a withholding tax certificate, 3. The property is intended as own residence, 4. Basic communication level in Japanese.

Investors, Companies

Japanese real estate investments tend to maintain a more stable yield and therefore yield gap (gap between real estate yield and the 10-year JGB) than other countries.

Real estate lending volume by banks is increasing in Japan. It has become relatively easier for property buyers to leverage their investment by borrowing money. Japanese banks are generally more supportive of lending money to non-residents who invest in Japanese properties.

Japanese financial institutes prefer to provide loans to companies established in Japan.

A range of financing options exist such as non-recourse loans, syndicate loans and just balance loans. In the case of non-recourse loans, financiers will require multiple conditions to be satisfied ( e.g.: Valuation report, Engineering Report, Legal due diligence, Cash flow assumption, etc).

The LTV ( loan-to-value ratio) required depends on the purchaser of the property, the nature of the property being acquired and the purchaser’s and agent’s relationship with the financier. It’s common to see an LTV in the range of 50-70%, and the interest rate in the range of 1.5-4%. An alliance with an established and reputable Asset or Property Manager can result in improved financing conditions.

Search

- TOP

- Column List

- real estate Investing in Japan – Guideline –